I’m in my 20’s. How do I invest?

Answer

By wanting to invest this early in your life, you’re already taking advantage of the most important asset you have as an investor (Time). You really only need 3 other things.

- An investment vehicle/fund (to invest in stocks);

- A discount brokerage account;

- Conviction – the most important trait of a long-term investor.

The investment fund/vehicle is easy. To start, I would seek out the lowest-cost index fund that represents the entire US Stock market. One example would be Vanguard’s VOO, which holds a bit over 500 stocks and has an MER of 0.04%.

There are many discount brokerage accounts you can set up. Choose one that has an efficient online platform, is low in fees and minimizes any trading costs for index funds or ETFs.

The Conviction part is hardest. Most people don’t ever get this. You’ll need it to be a successful investor over a long time horizon. Here’s what I mean.

Consider the following chart showing the historic annual returns of the S&P 500 over the last 90 years or so. If invested in a fund representing this index fund, your portfolio return could range from -42% to +55% in any given year.

You’re likely going to have an investment time horizon of 60+ years (hey, if you’re starting this young, you may be able to stop working before you’re 50, but you’ll still be investing well after that). Over this time horizon, you’re bound to experience multiple years of ups and downs. It’s during the severely down years (e.g., times like 1929, 1970, 2002, 2008, etc.) where you’ll need to have the Conviction to stand still and do nothing differently. That, in spite of the paper loss, you’re still doing the right thing.

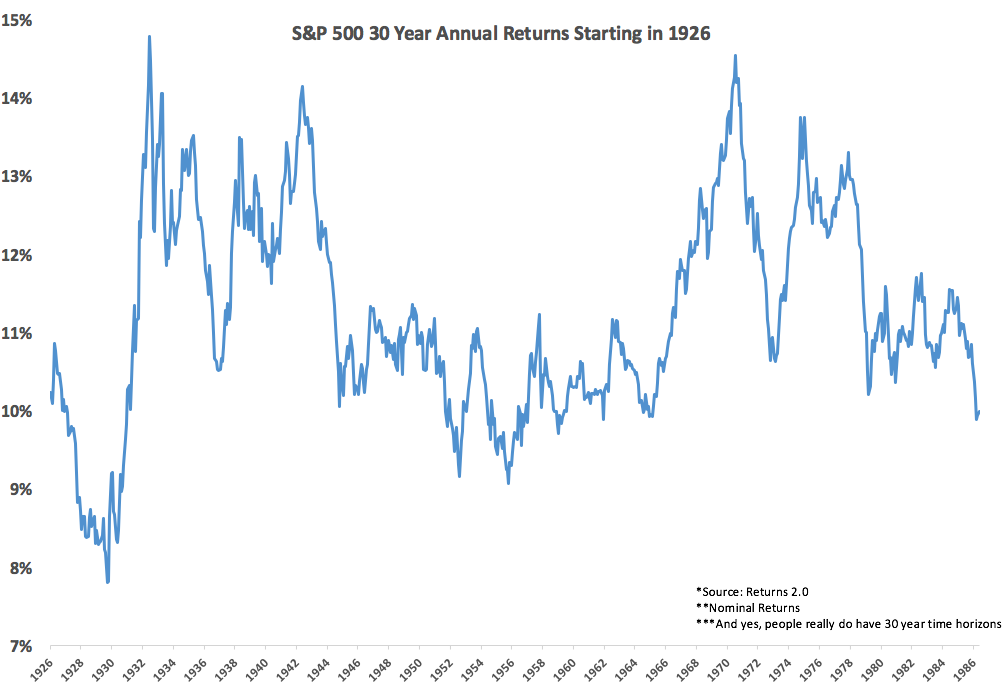

The following chart may help. It also shows the historical returns of the S&P 500. However, it displays the returns in the form of the rolling 30-year Compound Annual Growth Rates (CAGR). That is, the effective annual (compounded) returns over all of the 30-year investment periods from 1926 to 1986.

To be clear, these are the effective CAGRs for the 30-year periods 1926-1956, 1927-1957, all the way to most recent period of 1986-2016.

Consider this. Over the past 90 years or so, if you had chosen the worst possible day to put a lump-sum of money into the market for 30 years, it would have been the day before the stock market crash of 1929 (Monday, October 28, 1929). However, if you had the Conviction to keep that money invested for 30 years, you still would have achieved a CAGR of just under 8% per year (not awesome, but still much better than most average investors in almost any time period).

On the flip side, if you had been extremely lucky and invested your lump sum in 1970, you would have achieved a CAGR of approximately 14% over 30 years (by the year 2000).

I hope this gives you the knowledge that investing over a long time horizon and having the Conviction to stay the course through all of the short-term downs and ups will serve you well. In particular, you’ll do much better than the majority of “investors”.

Also, note that unlike the above examples, you won’t really be making only one lump-sum investment. You’ll likely be investing regularly over 30+ years. This has the added effect of further smoothing out your returns. Based on the preceding 90 years, you’d probably achieve a CAGR of somewhere between 10-11% (that’s per year) over your investment lifetime.

By the way, if you invest $1000 today and then $1000 each year for 30 years with a CAGR of 10.5%, you will end up with about $200,000 (on an investment principal of $30,000).

Congratulations! Happy Investing!

Recent Comments