Financial assets can be classified into the following two groups:

- “Loaner” assets such as interest-bearing accounts, treasury bills, GICs (Guaranteed Investment certificates) or bonds. These are assets where interest payments are collected from a borrower based on a lending contract (a debt instrument); and

- “Owner” assets such as shares of businesses (small and large company stocks) or real estate. These are assets that generate profit or income and also has a potential for price appreciation (or depreciation).

Each of these asset classes may expose an investor to risk (i.e., permanent loss of buying power). For “loaner” assets, a borrower may be unable to pay interest or repay the debt entirely. For “owner” assets, a business may underperform or the stock or real estate market may suffer periods of depressed prices at a time when an owner needs to sell.

“Owner” assets tend to exhibit much higher price volatility than “loaner” assets. This is especially the case over short periods of time (e.g., 0-5 year).

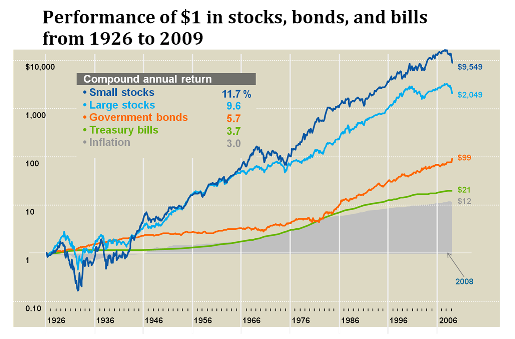

There’s a rich amount of historical data that ranks “owner” and “loaner” asset classes from best to worst over the long term. The results are unequivocal.

The above chart summarizes the value of $1 invested in different asset classes over the past 80+ years. This chart shows that over most 15+ year periods, an investment in equity assets has almost always outperformed all other (“loaner”) assets.

Looking at this record, it’s no wonder long-term investors (those with 15+ year to invest) should choose to “own” vs. “loan”. In the short term, stocks can be volatile. In fact, in any given year, stock prices can go up or down by as much as 10%, 20% or even more. However, in the long term, ownership of business that create value every day will significantly outperform every other asset class. In particular, over the long term, “owners” of a diversified set of assets will almost always make more than “loaners”.

If you really think about it, this is the only way it can be. This is because borrowers (i.e., the ones who create the loaner vehicles by borrowing to buy assets) are the owners of the businesses that issue the bonds the GICs and the high interest savings accounts in the first place. So over the long term, if borrowers don’t make a significantly higher rate of return on their business investments versus their cost to borrow, then the whole system would just stop.

For this reason, over a long investment horizon, the case for owning shares of businesses (equities) as the means by which to grow wealth is overwhelming.

Recent Comments