Checking Historic Performance.

As we’ve already discussed, the combination of short-term performance constraints and the fees charged makes it nearly impossible for all but the luckiest of fund managers to succeed.

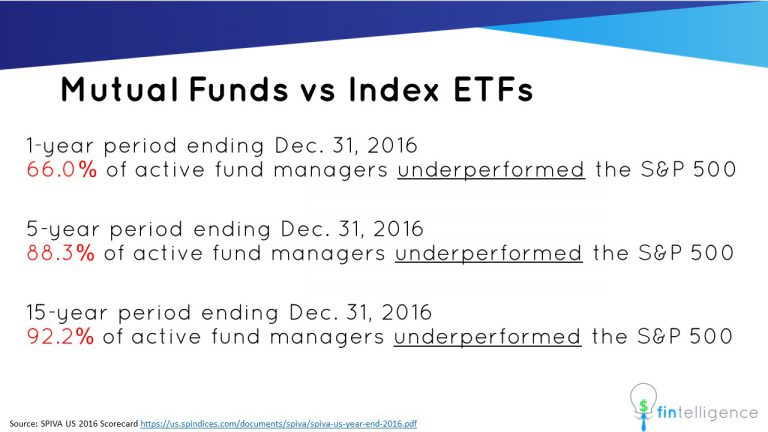

Here’s the sad truth from some recent research .

The good news is that 7.8% of funds actually outperformed the S&P 500 over that 15-year period. The bad news is that you can only find the best performing funds by looking in the rear view mirror.

On top of these sad statistics, it turns out that, on average, individual investors achieve returns that are even worse than mutual funds. This is because we tend to be our worst enemies when we trade (past) losers for (past) winners. The following chart from a recent 10-year study shows the average investor achieved a paltry annual compound rate of return of only 2.6% between 2004-2013. This, in spite of the fact that the entire stock market gained by over 7.4%.

It would seem that by pursuing the best (past) performing funds, many investors tended to buy high and sell low. Yet another reason to avoid mutual funds altogether.

Recent Comments