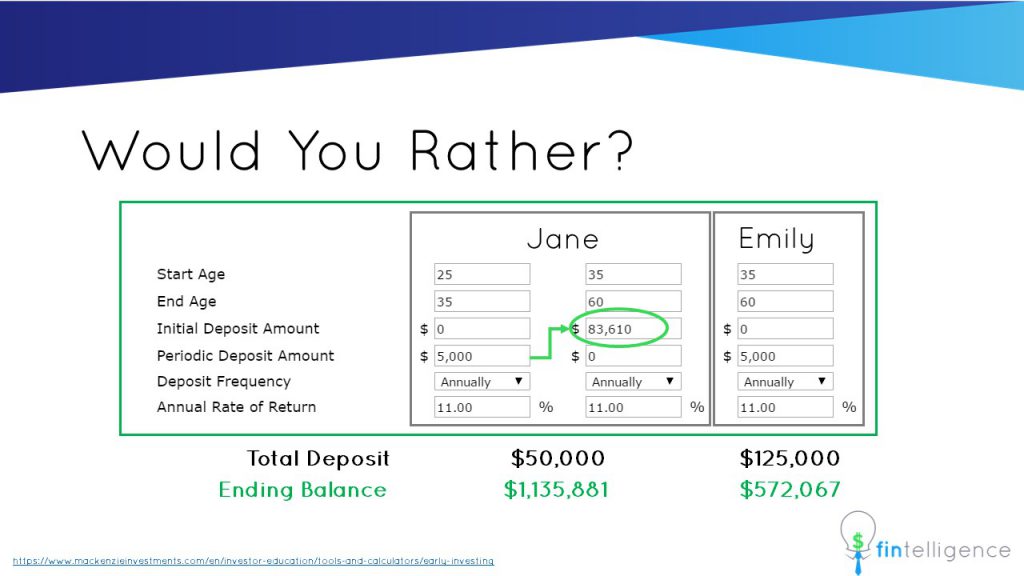

One of the questions I ask the group during the Financial Literacy workshop is: Would you rather

A. Invest $50,000 to get $1,100,000; or

B. Invest $125,000 to get $570,000

The room laughs nervously. Everyone is thinking the answer is obvious, but perhaps it’s a trick question.

The answer is obvious and it is not a trick question. However, when it comes to investing for the future, most people choose option B (if they invest at all).

Consider the following example. Jane and Emily are the same age. Jane starts investing at the age of 25 and manages to invest $5000 per year until the age of 35, but only until the age of 35. She stops after that. Over 10 years, Jane has managed to invest $50,000. Assuming a compound annual rate of return of 11% (why 11%), Jane will have $83,610 at this age.

Emily, on the other hand, waits until the age of 35 to start investing. In order to try to catch up to Jane, Emily decides to invest $5000 per year until the age of 60. After 25 years, Emily has managed to invest $125,000.

Assuming the same compound annual rate of return (11%), Emily’s investments will have grown to $572,067. However, during this same 25 year period of time, Jane has kept her money ($83,610 at the age of 35) invested without adding a single penny. This investment will have grown to $1,135,881 by the age of 60.

The real cost of starting late

The chart below summarizes their investment results.

Like Emily, most people do not recognize the importance of investing early in life. Its impossible, to make up for those lost years. This is the real cost of starting late.

Recent Comments