Many investors lose because they try to win. That is, they try to outsmart other investors by trading their investments based on short-term predictions of the future price of their holdings.

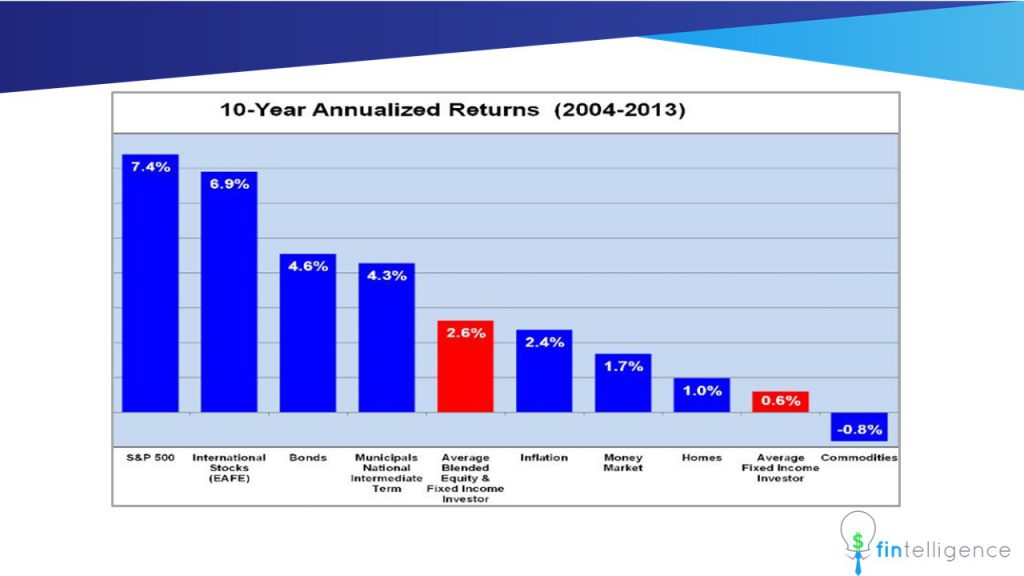

A recent study, published by Forbes magazine shows the “average” investor had underperformed a wide range of asset classes by a very wide margin.

Most people think of the stock market as a place to “Win” or “Lose” – a zero-sum-game where “smart” people can take money away from “less-smart” people.

Investing is not a Zero-Sum Game

It is for this reason they hire “smart” mutual fund managers and pay 1.5%-2.5% (or more) in annual fees to beat other investors. In fact, much of the investment industry is predicated on investors hiring “smart” fund managers to beat other “smart” fund managers. Through all of this noise, and all of these fees, it’s easy to forget that stock investing is really about participating in the value creation of businesses and not transferring money from one investor to another.

Yes, it is possible to take advantage of dislocations between price and value of assets to gain an advantage over other investors. However, the overwhelming majority of small retail investors (over 90%) are on the losing end of this trade because they are trying so ineffectively to win.

Recent Comments